The European Union (EU) approval in February of the generalised system of preferences plus (GSP+) scheme for Pakistan for two years, formation of the Pakistan Textile Garments Leather Workers Federation to jointly fight for workers’ rights, and a decision to set up the first weaving city in Faisalabad were the highlights of the textile-garment sector in Pakistan in 2018. Dipesh Satapathy takes a look at the developments.

The European Parliament’s Committee on International Trade in February approved generalised system of preferences plus (GSP+) scheme for Pakistan for two years. Pakistan’s first biennial assessment report of GSP+ benefit was conducted in 2016.

The Indonesian parliament in November passed free market access to 20 tariff lines originating in Pakistan under the preferential trade agreement between the two nations. The tariff lines that will entail zero-duty with immediate effect include some types of yarn, woven fabric, T-shirts, vests, trousers, shorts, bed linen and terry towels.

The value of textile and garment exports from Pakistan increased by 8.67 per cent year-on-year in dollar terms in fiscal 2017-18 ending June 30, according to the Pakistan Bureau of Statistics.

Attributing Pakistan’s growing trade deficit to low exports, the Pakistan Readymade Garments Manufacturers and Exporters Association (PRGMEA) urged Prime Minister Imran Khan in August to declare an ‘export emergency’ to tackle the exports sector decline. Pakistan’s current account deficit rose by more than 40 per cent in fiscal 2018-19 to $18 billion.

The government in May allocated ₹2.5 billion to boost the production of cotton during fiscal 2018-19 and ₹100 million to establish an Institute of Fashion and Design in Karachi.

The area under cotton sowing in Pakistan reduced by 26 per cent due to the absence of appropriate crop zoning in the country, posing a serious threat to the production of the cash crop, cotton commissioner Khalid Abdullah told the Senate Standing Committee on National Food Security and Research in December.

Cotton arrival in the domestic markets reduced by 700,000 bales this fiscal compared to the last, he said. The Central Cotton Research Institute’s cotton variety Bt CIM-632 received commercial license in December.

The country signed an agreement in May with Afghanistan to facilitate bilateral trade and import Afghan cotton. The cabinet in November approved import of cotton from Afghanistan and central Asian countries through the land route to meet its shortfall.

An MoU was signed in July between the Faisalabad Industrial Estate Development and Management Company and the All Pakistan Cotton Power Looms Association to set up the first weaving city in Faisalabad.

The Federal Board of Revenue (FBR) in January withdrew 5 per cent sales tax and 4 per cent customs duty on cotton imports. The move, however, was resented by cotton growers. In July, it withdrew sales tax zero-rating facility on the import of raw and ginned cotton and imposed 5 per cent sales tax on this item at import stage.

FBR imposed regulatory duties on the import of various textile items in October. Fifty per cent duty was imposed on the articles of apparel and clothing accessories, of leather or of composition leather.

The Pakistan Hosiery Manufacturers and Exporters Association in January expressed concern over increasing taxes on the import of polyester yarn, saying the step directly affected the sportswear industry of Sialkot. The government had imposed a 5 per cent regulatory duty on such import with an average 7 per cent anti-dumping duty.

The Pakistan Textile Exporters Association in December demanded immediate release of outstanding duty drawback of taxes claims to enhance exports. The cash crunch had squeezed the financial stream, making it tough for exporters to meet commitments, it claimed.

Textile exporters have also voiced strong reservations over the government plans to float security bonds for clearing tax refund claims of businessmen.

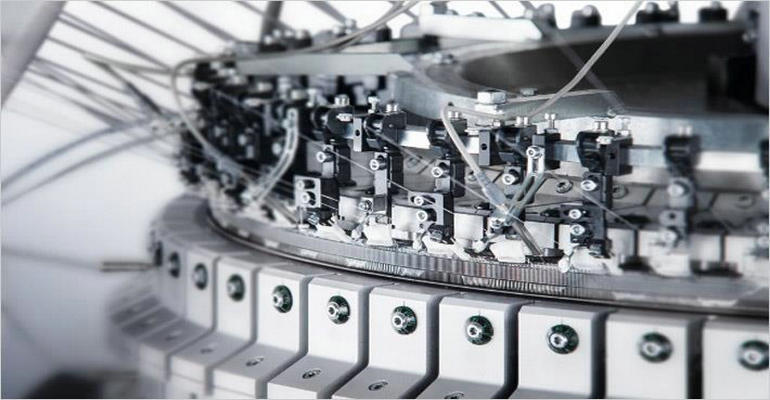

All Pakistan Textile Mills Association (APTMA) members said in March they were ready to set up 1,000 garment manufacturing plants in cities like Lahore, Sheikhupura, Faisalabad, Kasur, Multan, Sialkot, Rawalpindi, Karachi and Peshawar with an investment of $7 billion to resolve the crisis in the sector. The planned units will install half a million stitching machines, which will boost annual production to three billion pieces.

Textile companies in April signed 63 deals worth $245 million with foreign firms at the 19th Textile Asia Exhibition in Karachi. With agreements worth $150 million, Chinese companies had the greatest share.

According to a study released in May by the Federation of Pakistan Chambers of Commerce and Industry, multiple taxes and surcharges of up to 11 per cent, lack of complete implementation of government’s support in Strategic Trade Policy Framework (STPF) and textile package, low cotton bales production, uncompetitive utility and issues related to raw materials were some of the key problems related to the textile sector.

Pakistan’s textile export declined by close to 10 per cent between 2011 and 2018, while exports from India, China, Bangladesh, Vietnam and Sri Lanka have increased at a compound rate of 20 per cent, it said.

PRGMEA in September urged the government to set up Pakistan trade houses, i.e., display centres, in Dubai and Rotterdam to help domestic exporters.

Member companies of China's Chongqing Federation of Industry and Commerce decided to invest $400 million in trade and industrial projects, including those in the textile sector, in Hyderabad and other parts of Sindh province after the federation signed an MoU with the Hyderabad Chamber of Commerce and Industry in September.

The various unions in Pakistan’s textile and garment industry formed the Pakistan Textile Garments Leather Workers Federation in September to jointly fight for workers’ rights.

Asia's biggest international trade exhibition, Textile Asia-2018, in Lahore in September witnessed signing of agreements for joint ventures (JVs) worth $175 million. Chinese companies at the show from places like Shanghai, Guangzhou, Jiangsu, Fujian and Shandong showed interest to relocate their textile, garment and accessories production units to Punjab, with investments of at least $25 million for each unit.

In the major cotton producing province of Punjab, total cotton arrivals increased by 3 per cent year-on-year to 3.123 million bales.

In October, Pakistani manufacturers and exporters of knitwear garments planned to adhere to environmental laws in their factories within a year through technical support from the Punjab Environment Protection Department.

US-based Tukatech opened three computer design labs in October for digital pattern, textile, and apparel design, including 50 TUKAcad stations for digital pattern-making and several TUKA3D stations for virtual sample-making at the National Textile University (NTU) in Faisalabad.

The Pakistan Yarn Merchants Association (PYMA) in November criticized imposition of anti-dumping duties between 3.25 and 11.35 per cent on import of polyester filament yarn (PFY) from China and 6.35 per cent on such imports from Malaysia. Three-fourths of the domestic requirement of such yarn is met through imports. The anti-dumping duties are unjustified as the domestic industry in Pakistan is incapable of meeting the yarn demand, PYMA said.

NTU joined as a founding member of the ‘Belt and Road World Textile University Alliance’ at the World Textile and Fashion Education Conference held in Donghua University in Shanghai in December. The alliance includes 38 textile universities from 27 countries.

Organic cotton cultivated in Pakistan, primarily in Balochistan, will be certified by global agencies from next year, the World Wildlife Fund-Pakistan (WWF-P) and the Karachi Cotton Association (KCA) announced in February. WWF-P will supervise the procedure and a certified verifying body will inspect the crop’s quality.

中文

中文